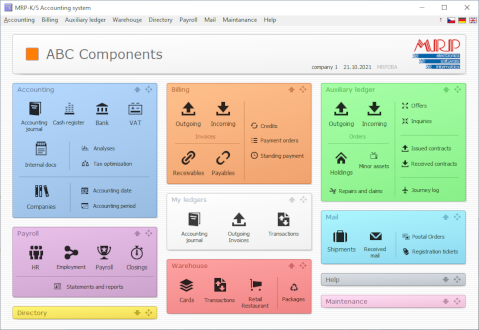

MRP-K/S, accounting system

Flagship MRP accounting program! Comprehensive administrative–informational system, a new yardstick of accounting systems that pushes the limits of perfection. MRP–K/S is a robust system working with maximum precision and reliability while managing to keep flexibility that is needed to keep up with ever–changing legislation. The interface is simple, elegant, and very user–friendly. Due to utilisation of highly productive SQL Client/Server and DMAL® technologies, the price of this accounting system is simply unbeatable. It is a great tool for users, that require reliability and safety for company data. This clever and creative system will help you optimize your taxes in such way, that you pay as little as possible within the scope of the law in force. It allows automatic entry into accounts for invoices, payables and receivables, cash register transactions, internal documents, warehouse transactions, bank statements and payroll.

Program is made for administration within the scope of Czech legislation.

MRP-K/S accounting system interface is available in English and German.MRP-K/S accounting system is designed for:

- entrepreneurs and sole traders (natural persons)

- small, medium-sized and large companies

- VAT payers and non-payers

- employers with any number of employees

- contributory and non-profit organisations

- accounting companies and tax advisors

- work in local area networks, over the internet and of course also on a single computer

MRP-K/S accounting system supports GDPR by:>

- Detailed setting of user access rights in individual modules

- Prohibiting unauthorized persons from accessing data - Client/Server architecture

- Encryption of Accounting data backups

- Encryption of pay slips, sent to employees via email

- Logging accesses and changes

- In case a natural person requests a deletion of personal information, MRP-K/S accounting system allows to search all accounting documents related to this person in an elegant way (even traced years back) and therefore to find out the closes date of actual deletion of the data of the person in question based on other legal reasons.

- Various GDPR events may be set for individual addresses that can be then used for searching and filtering.

- Data anonymisation - when working with the complete database, it is possible to anonymize not just addresses, but also all contacts and payroll records.

If you are interested in this accounting software, MRP has prepared for you a fully functional version (just time-limited), where you can try out the functions of this accounting systems during its unrestricted operation.

Basic features of MRP-K/S accounting system>

- Maximum operation reliability and data safety, that can currently only be assured by using the top-level information technologies.

- Radically increased resistance of accounting data against computer viruses.

From all currently known viruses that can be found on the internet we have not been able to identify a single one that could destroy or even partially corrupt accounting data on our testing server from a client station.

This server was separate from client station and had standard software security installed.- Simple controls. When designing the system, we built up on the interface used in visual accounting system. We did not want to bother user with the need to learn new controls. On the first glance, users that upgrade from our visual accounting system to MRP-K/S, cannot even tell that they are working on a brand-new and different system.

- Simple installation. It is common that installation of Client/Server applications can only be performed by top experts trained by the program creators. MRP-K/S installation on a single PC can be managed by an average user, the time needed to perform the installation will be similar to other programs that are not Client/Server type applications. Installation on several computers with the use of the network is however not recommended to a layman - nevertheless, an advanced user or network administrator will manage just fine.

- High-speed over LAN networks. A user, accustomed to working with simple local computers will probably not be able to tell that he is working on a network application. In comparison to other network applications that are not of Client/Server type, we managed to increase the speed considerably in some functions.

- Accounting companies and tax advisors will enjoy the possibility of bookkeeping for up to 9998 companies. They also appreciate this system for (amongst other) the possibilities of creating various cross-checks and business result analyses, which allows them to suggest their clients best tax optimisation within the scope of legislation in force.

- Low price could be achieved by utilizing new and very efficient DMAL® technology. Until now, only big corporations could afford Client/Server type applications. Price of Client/Server type applications from other developers is commonly an order of magnitude higher than our solutions.

Basic modules of MRP-K/S accounting system

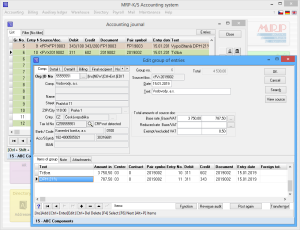

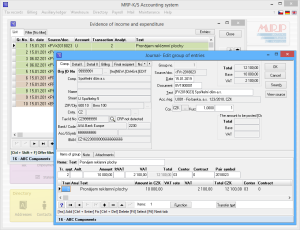

Accounting>allows for double-entry accounting for various types of organisations - entrepreneurs, contributory and non-profit organisations, VAT payers and non-payers. Accounting journal allows bookkeeping on synthetic and analytical accounts with detailed output summaries, e.g.: main book of synthetic and analytical records, purchase and sales ledger, VAT, ... Allows to perform set-offs between companies. Together with Electronic Filing Manager (Czech only) enables sending forms to authorities over the internet. It also allows for managing cash registers in foreign and domestic currency, profit/loss statements, balance sheet, trial sheet, cash flow, etc. for business subjects.Tax register>or single-entry accounting (for VAT payers and non-payers) allows for keeping records of incomes and expenses structured as needed to determine tax base, cash register journal, VAT tracking... You can be informed about your financials and material assets at any time, look over company economic result up to final annual closing (overview of incomes and expenses, assets and liabilities). Tax register module allows to monitor business activities in individual cost centres and orders. Outputs can be exported also to other windows applications (XLS, DBF, TXT, HTML, and PDF formats are supported). Supports home banking and trading via internet. Together with Electronic Filing Manager (Czech only) enables sending forms to authorities over the internet.

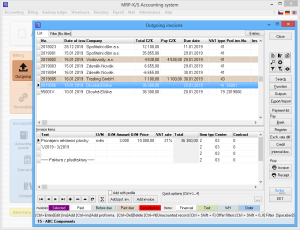

Incoming/outgoing invoices>are meant for VAT payers as well as non-payers. They contain output summaries, e.g.: invoice (tax document), invoice with posting, proforma invoice, invoice set-off, invoice list, credit note, debit note, delivery note, reminder, payment list, cash register receipts etc. It is also possible to apply various filters when selecting these output summaries, e.g.: definition by time, invoice number, order number, cost centre number. Electronic billing management with digital signature of PDF documents, IN-HOUSE format (in a separate module EDI/IN-HOUSE) and ISDOC format. Inserts QR codes into invoices and proforma invoices in QR payment or QR invoice mode. Additional functions available for invoicing module - use of various number series, editing, copying, and cancelling invoices, exporting outputs to txt, dbf and xls files, exporting data from incoming invoices directly into payment orders, ... For invoices received, verification of VAT payers reliability and their accounts.

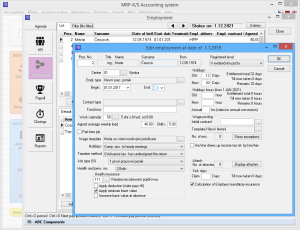

Allows for invoice import online for Turbofaktura invoicing system (Czech language only).Wages and Payroll>Payroll module represents sophisticated payroll accounting, allowing for automated posting of issued wage directly into accounting journal. Main benefits of the payroll program is that it allows for: :

- managing HR and payroll agenda for basically unlimited number of employees. No additional charges regardless of the number of employees.

- include employees in any cost centre

- use advantages of government Antivirus programmes.

- eNeschopenka support

- entering attendance, registration status, work performance of employees

- user-defined payroll items and their expressions for wage calculation

- calculation and registration of compensations in case of incapacity for work

- calculation and registration of pension insurance

- calculation and registration of life insurance

- calculation of executions

- calculation and registration of compensation for sick days

- work with registration sheets of pension insurance and creating data for their electronic transmission

- work with registration sheets of health insurance and creating data for their electronic transmission

- printing considerably detailed output summaries: payslips, slip of tenders, summarisations, insurance statements for pension insurance and private health insurance, wage lists, payment orders, annual wage lists, compensations in case of incapacity for work, requests for missing monthly tax bonus, confirmation of taxable income, annual income tax statement for employee as well as company, employee HR data, employment confirmation sheet, attendance, work performance

- carrying out electronic connection to bank - internet banking

- export of data for ISP and ISPV statistics

VAT>Allows for complete VAT processing. This includes records of outgoing and incoming tax documents as well as calculation, print, and export of VAT return, VAT summary and control statement in format required by Internal Revenue Service of the Czech Republic. Automated system enables performing reliability verifications for VAT payers and their accounts.

Income tax>The program facilitates preparation of tax returns and allows for printing corresponding forms. The module contains annually updated tax return forms for legal persons, natural persons, and annual overviews for self employed persons for General Health Insurance Company and Social Security Administration. The forms are supplied with context help and instructions for filling out the forms correctly. Filled out forms are archived in the program, identification data may then be used to fill out the form for the next period automatically.

Tax optimization>

Tax optimization>The module that will help you save money! With this module you can easily monitor the state of your accounting, analyze previous business activity in your company, and use the gathered data for future strategic planning. Functions of this module are of great use not only to accountants but also to management staff, responsible for pay taxes on time and at the minimum amount required by law.

Modifiable output summaries and good interconnection of individual modules are also helpful during audits by inspecting authorities. Using variable filter settings you can submit output summaries to respond to any request, which should satisfy even the most "diligent" officers.

Supplier/customer address book>

Supplier/customer address book>with various search options, e.g. by company name, name of the contact person, company ID No. VAT ID, City, Postal Code, note, etc. Allows printing address lists using various filters, print addresses on envelopes or labels of various formats. Enables performing reliability verifications for VAT payers and their accounts.

Warehouse and Packaging records>

Warehouse and Packaging records>with output summaries such as receipt card and issue slip, list of transactions, turnover by transaction type, lists of cards, composite cards, stock keeping, price lists, serial numbers, etc. Allows for accounting via both A and B method. Pricing of stock is possible by weighted average or FIFO method. Besides warehouse price, it is possible to work with five sales prices that can be kept in various currencies. Supports INTRASTAT. Furthermore, users were intrigued by speed and sturdiness of the system, interconnection between orders, invoicing and retail, various filtering and control functions, program behaviour parameterization, barcode support, inventory records, scope of price policy (surcharges, margins, price groups) etc.

Packaging records Packaging records help to observe all obligations as per act No. 477/2001 Coll. Source summary for filling out EKO-KOM statement, lists of issued packaging, etc. are included in the primary output summaries of the system. You can apply search filters, such as search by packaging name, code, use, payment, type, origin, etc. There is a direct link to Warehouse cards of the Warehouse module. Economic and financial analyses>

Economic and financial analyses>

Economic and financial analyses in 3D animated view for accounting, invoicing, warehouses and their transactions, and payroll. Well arranged graphic form facilitates analyses of various scope, from daily operation up to several year periods, which is appreciated mainly by managing directors and financial planners Besides commonly required economic analyses such as comparison of costs and revenues, HV, cash flow, bank account states, etc. it also allows creation of user-defined graphs with own links between individual accounts.

Asset records>Secures monitoring of various asset types. Allows monitoring the entire history of tax and accounting depreciations and residual values accurately on by-month basis, including technical appreciation and depreciation interruption. Following depreciation can be calculated based on user-selected condition for individual cards or in bulk. It can be used for planning of future depreciation of acquired assets. Tax or accounting depreciations in the selected period can be posted in mass or separately according to selectable item class. Asset records module enables records filtering, search and printing corresponding summaries. It also allows for depreciation calculation in economic year, i.e. accounting period, that is different than calendar year.

Retail>

Retail>

Individual client station can be used as retail cash registers with on-line connection to warehouse module. Retail module enables detailed authorization setting for each salesman. It keeps records of grand totals (net, gross, negative). This module allows to perform closings (daily, monthly, annual), monitor work of individual salesmen, supports use of payment cards,... Discounts or surcharges can be set to individual items or entire receipt. It works with other PC accessories supplied by MRP: customer display, cash drawer, receipt printer, barcode reader. Interface is suitable for classic keyboard control as well as touch screen.

Restaurant>is based on retail. It allows to have several accounts open at the same time, merge and separate individual accounts, print orders of meals on a separate printer in the kitchen etc. Interface is suitable for classic keyboard control as well as touch screen.

Auxiliary ledgers (book of orders, cash register, driver's logbook)>

Auxiliary ledgers (book of orders, cash register, driver's logbook)> Order book with various search options Cash register book - option to have several register in various currencies and able to perform check with posting in journal. Driver's logbook allows to keep records of company motor vehicles, their usage, use of private vehicles for business purposes and calculation of travel expenses. The logbook allows to keep an unlimited amount of vehicles and journeys without any additional charges. The program is also capable of working out the road tax.

Order book with various search options Cash register book - option to have several register in various currencies and able to perform check with posting in journal. Driver's logbook allows to keep records of company motor vehicles, their usage, use of private vehicles for business purposes and calculation of travel expenses. The logbook allows to keep an unlimited amount of vehicles and journeys without any additional charges. The program is also capable of working out the road tax.Auxiliary ledgers

- Order book with various search options

- Cash register book - option to have several register in various currencies and able to perform check with posting in journal.

- Driver's logbook allows to keep records of company motor vehicles, their usage, use of private vehicles for business purposes and calculation of travel expenses. The logbook allows to keep an unlimited amount of vehicles and journeys without any additional charges. The program is also capable of working out the road tax.

Internet banking>Book of bank statements

with via import from internet banking facilitates efficient creation of bank statement database. Statements downloaded from the internet can be semi-automatically paired with accounting journal and invoice ledger. This is especially useful when working with large amount of data. Supports formats ABO BEST KB/M-BEST, Czech Postal Service, CITIBANK Internet, GE Capital and other. It also works directly with banking products such as Direct Canal by the Bank of Commerce. It can retrospectively create and print bank statements that are available only in electronic form.

Book of Payment orders

It can create, email, or print single or multiple payment orders. There orders may be created by direct data entry or by export from other modules (e.g. Book of Incoming invoices). The created orders are kept in archive for later inspection if needed. Supports various internet banking formats (ABO, BEST KB, CITIBANK Internet, ...). It also works directly with banking products such as Direct Canal by the Bank of Commerce.

CRM>

CRM>

or Customer Relationship Manager enables tracking activities in the company, assign tasks to workers, unite activities under common projects. Efficient tool for communication the company and its employees and customers. Activities are sorted and arranged with planning calendar. Monitors individuals progress on specific tasks, check work in progress of individual tasks. CRM is link with Address and Contact modules.

Mail records>

Program for recording send and received mail, print of postal book and postal orders of various types on laser and inkjet printers. It also allows to connect a compatible digital scale. It is then possible to calculate postage etc. Recipients of standard postal shipments can be notified via email about receiving registered letter, COD shipment, parcel etc. It also informs the recipient about tracking numbers, date and place of shipment submission and COD price, if applicable. Supports electronic filing system of the Czech Postal Service, and printing registration slips and ten-days statement.

Repairs and complaints>Module allows managing warranty and post-warranty repairs. Aside from basic record keeping, the module allows to keep list of related organisation tasks and list of materials and works. Sate of the order can be colour-coded based on user setting according to order settlement date. The material can be taken from preset items or warehouse cards.

It is possible to change the colour scheme of the service order list and period for performing warranty and post-warranty repairs in the settings. This period is then added to the date of order reception and pre-sets the date for completing the repair. The customer is entered into address records. Contract (received and issued)>

Contract (received and issued)>Brand new module used for recording received and issued contracts. It is possible to save original contracts to every record as attachments in common formats (i.e. PDF, JPG, DOC etc.).

Multi-version>

Multi-version>

Allows transparent bookkeeping that can be traced back many years. Using this module, accounting companies may manage bookkeeping for up to 9998 companies. It can create identical copies of the selected company (or accounting year) and perform e.g. training postings of various documents, test deletions, data correction, trial annual closings etc. When transitioning to a new accounting year, documents can be posted in the new and the old year and the old documents can be posted in the previous year retrospectively.

Data maintenance, user access settings for individual modules>User access setting is so detailed that besides the standard levels of access (no access, read only, read and write) it allows to set various combination of access levels between individual modules, based on the internal logics and links of individual modules and accounting method.

Individual modules are linked together. The entire system has output summaries, modifiable by the user. Outputs can be exported also to other windows applications (XLS, DBF, TXT, HTML, and PDF formats are supported).

Auxiliary modules of MRP-K/S accounting system

These modules are not a standard part of basic installation of MRP-K/S accounting system.

Click here for more information...

The accounting system is built on a database server that is free to use without any additional charges. User of this accounting system does not have make additional investments into an expensive database server.The whole software package installation is separated into the following two parts:

- One part runs on a windows or Linux (Debian, Ubuntu, CentOS,...) workstation designated as server.

- Second part runs on a standard windows (Windows 10, 11, 8, 7/Vista) workstation designated client. The client part requires minimum screen resolution height of 900 pixels. Even most basic current 1080p monitors will meet this requirement with a considerable margin, even older hardware with screen resolution of 1440x900, 1280x1034, 1280x960 or higher will work.

Note: If both client and server are run on a single workstation, then a standard windows OS is required (Windows 10, 11, 8, 7/Vista).

The accounting system MRP-K/S was built as a network application from the start (for LAN or WAN networks), the user will buy only as many licenses as he needs to use simultaneously. Basic price includes complete accounting software MRP-K/S (in case of modular version the software of the purchased module MRP-K/S) for installation and use on a standalone workstation or for network use with a server and client workstations, in which case the licence is needed for the client workstation.